Who are your close relatives?

DISCLAIMER: Please note that this article does not constitute legal advice and does not create an attorney-client relationship between the reader and the publisher. Our views are subject to change without obligation to notify the readers of this article. This article does not speak on behalf of OFAC or any government agency and is a statement of our own reading and analysis of the law. Especially in any situation that is more complicated and requires a more thorough study and analysis of the facts, please consult and rely upon your own lawyer. Please also reach out at blog@trylindo.com if there are any inaccuracies that we need to correct or feedback to consider!

Copyright notice

As between you and the SanctionsPower.com blog, owned by Value Exchange Solutions, Inc (“Sanctions Power”), Sanctions Power owns or licenses all data, content, graphics, forms, artwork, images, and documentation and other material on, in or made available through the Site (“Site Material”), as well as the selection, coordination, arrangement, and organization and enhancement of the Site Material. You agree not to remove or alter any copyright notice or any other proprietary notice on any Site Materials.

If you do not agree, you are not granted permission to use this Site and must exit immediately.

Introduction

In our previous article, we explained how our remittances to Cuba are legal and mentioned we would be releasing an article that explained the definition of 'close relative’ according to Section 515.339 of the Cuban Assets Control Regulations.

Understanding this definition is very important if you are planning to send money to Cuba. We ask all our guests to attest that to the best of their knowledge, the recipient is not a prohibited member of the Cuban government, Politburo, nor a "close relative" of such a person.

Furthermore, if you are selecting the option of sending money to a "close relative", you need to be sure that your relationship to the recipient indeed falls under the definition of a "close relative" as defined in the regulations.

Let's get straight to the details. Quoting the definition located in Section 515.339(a):

For purposes of this part, the term close relative used with respect to any person means any individual related to that person by blood, marriage, or adoption who is no more than three generations removed from that person or from a common ancestor with that person.

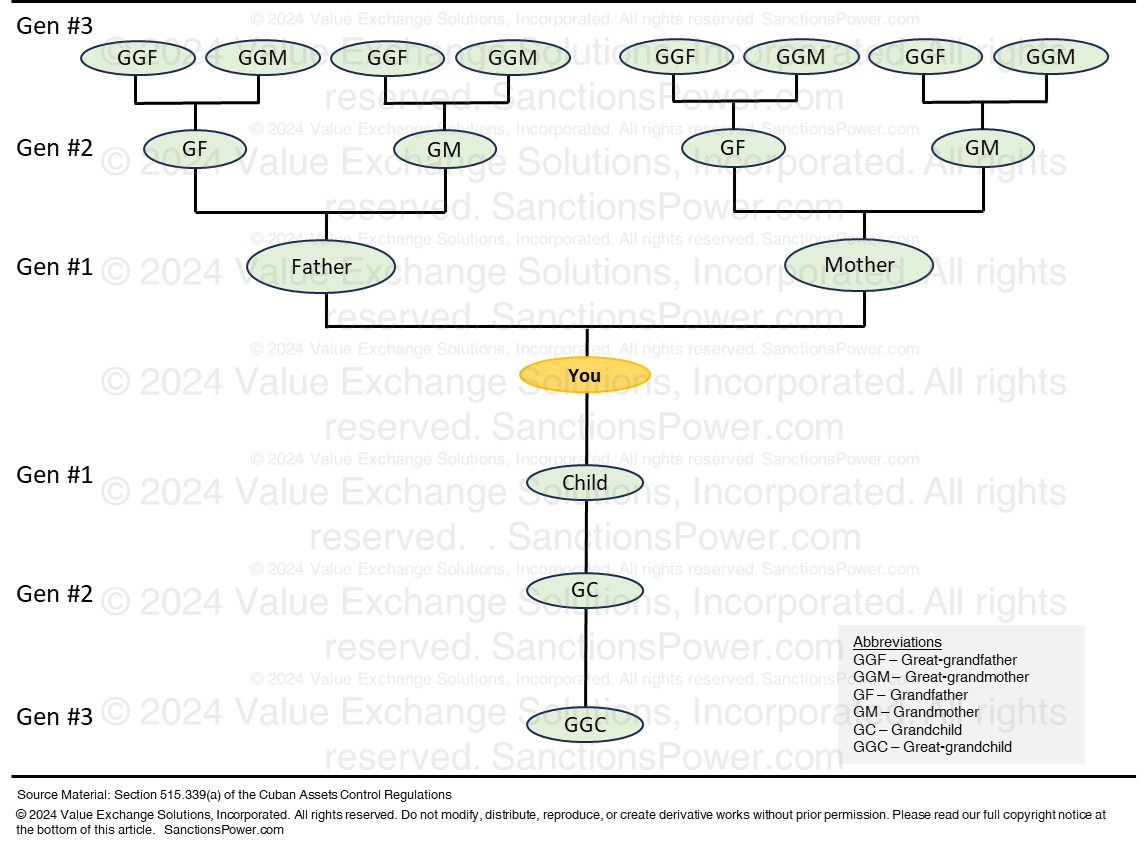

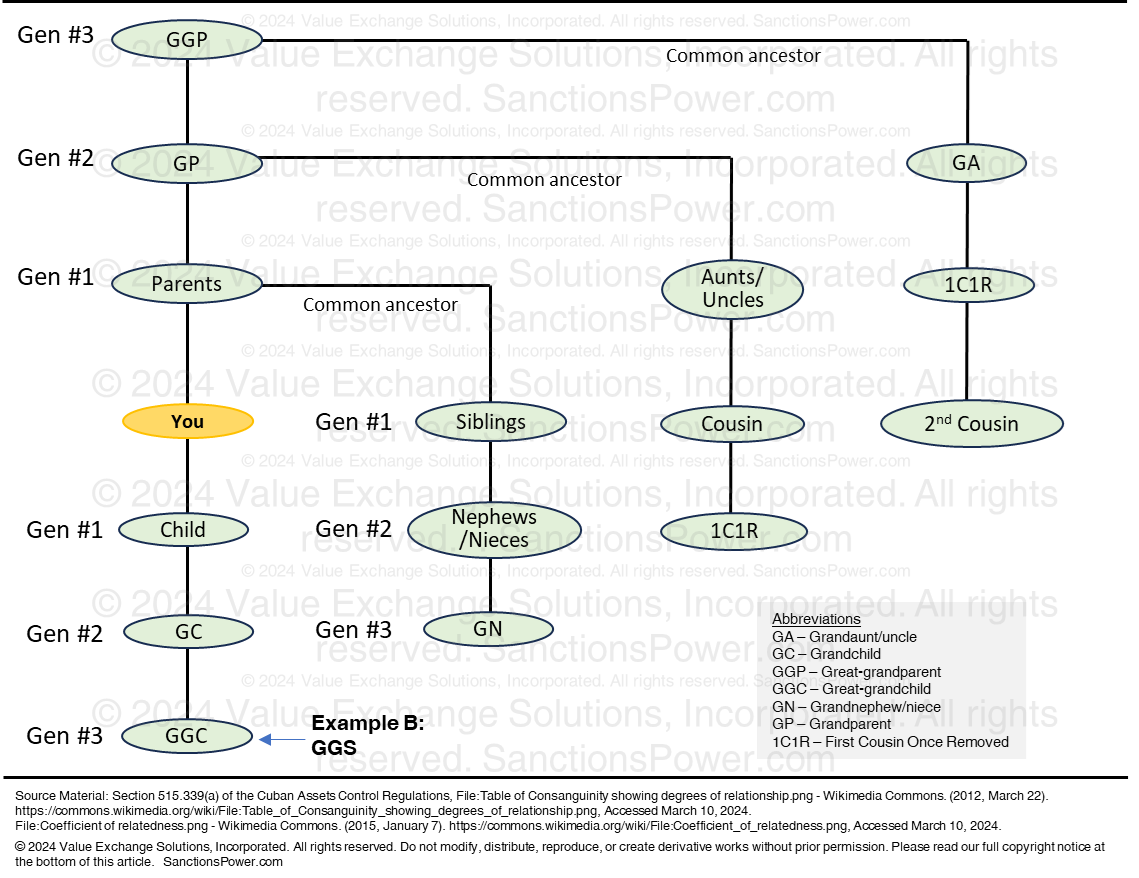

Unpacking this statement is a little tricky at the first try. At first glance, ignoring the clauses about marriage or adoption, at least anyone who is related to you by blood three generations above or below you is considered your close relative. That gives us – at least – the following picture:

Your great-grandparents are your close relatives, as are your grandparents, your parents, and your children, grandchildren, and great-grandchildren.

Hence, by virtue of existing, there are at least 14 people in the world, dead or alive, who would be considered a ‘close relative’ of yours today (your parents, grandparents, and great-grandparents).

Official examples of ‘close relatives’

OFAC also gives us 3 examples in Section 515.339(b).

Let’s go through them one by one to tease out the full picture of who else is considered a ‘close relative’. The first example helps us understand who else is part of the definition.

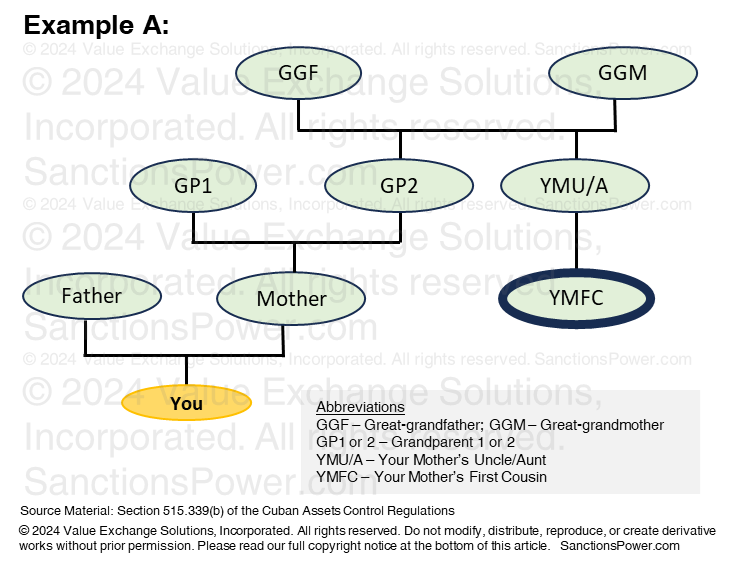

From the first of three examples in Section 515.339(b):

Your mother's first cousin is your close relative for purposes of this part, because you are both no more than three generations removed from your great-grandparents, who are the ancestors you have in common.

Your mother’s first cousin is also your ‘first cousin once removed’.

Since you and your mother’s first cousin / first cousin once removed share a common ancestor in your great-grandparents – in the chart as GGF and GGM, you are considered close relatives.

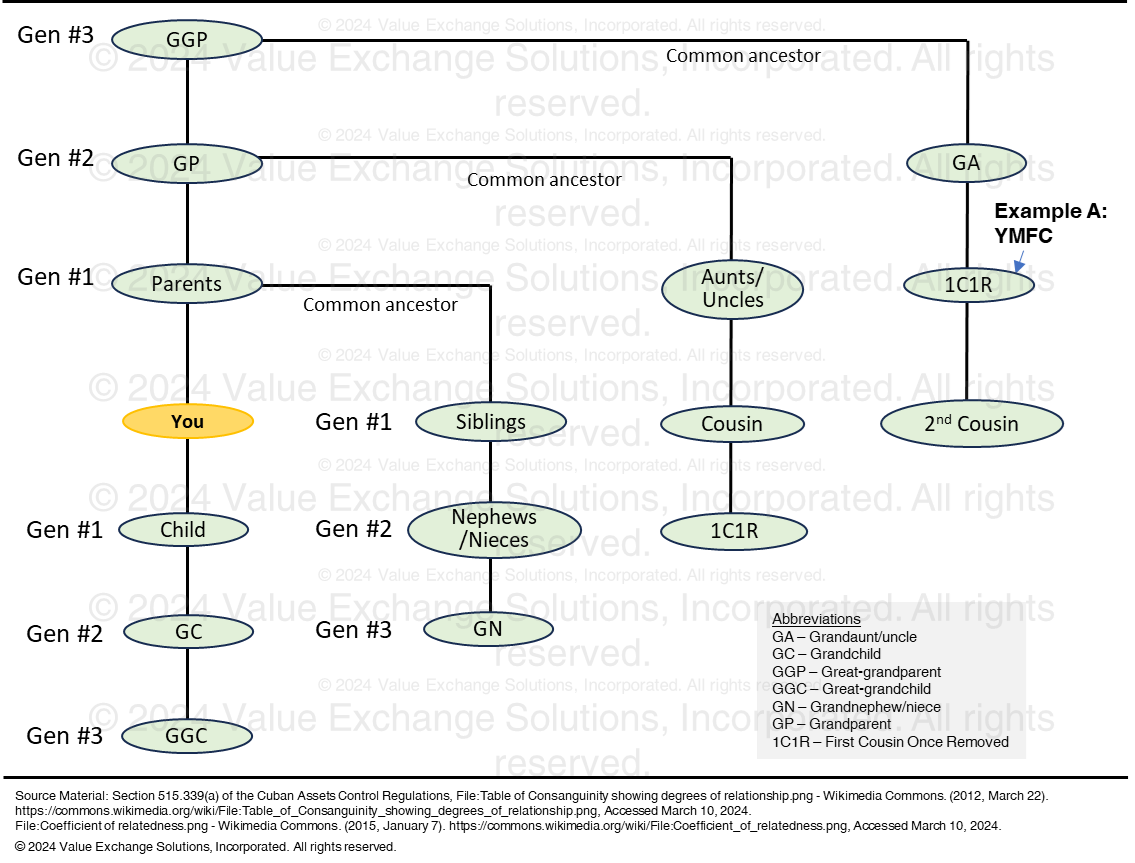

Generalizing, you are not more than three generations removed from your grandaunt, first cousin once removed, and second cousins, through your great-grandparents.

By logical extension, you are also not more than three generations removed, through your grandparents, from your aunts/uncles, their children (cousins) and grandchildren (first cousins once removed).

You are also not more than three generations removed, through your parents, from your siblings, nephews/nieces, and their children (your grandnephew/nieces).

This leaves us with the following picture:

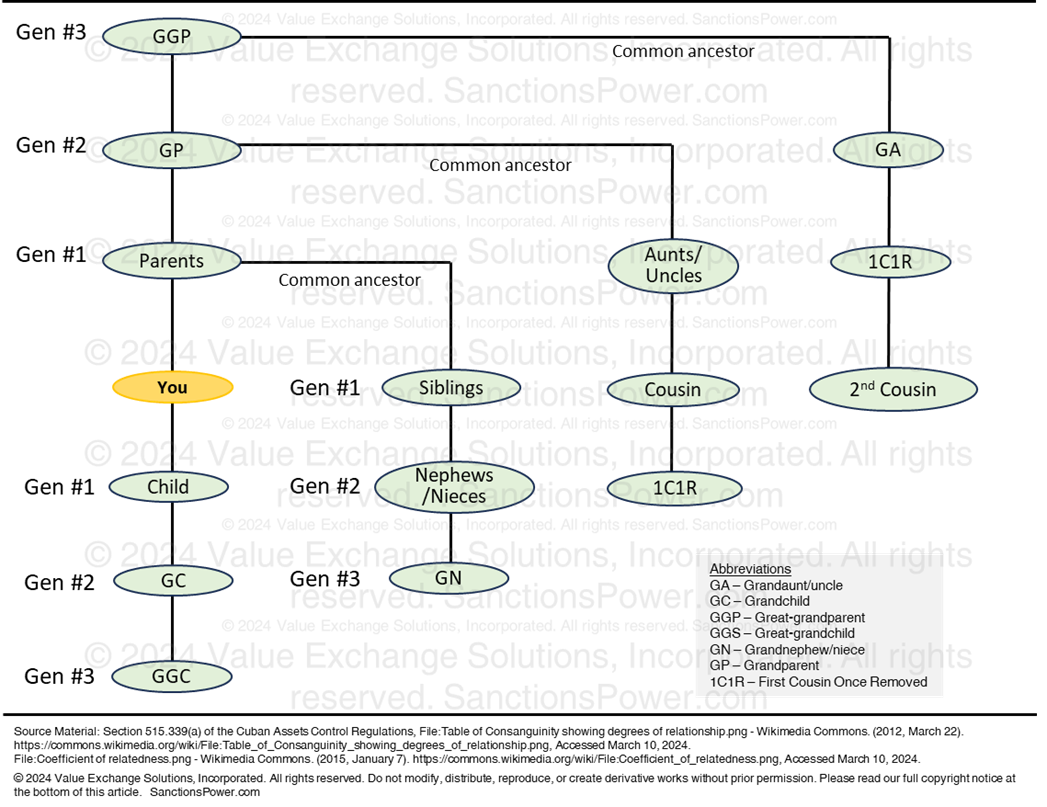

Let’s call this The Close Relative Family Tree, as we will come back to it later. Those descending three generations from (1) you, (2) your parents, (3) your grandparents, and (4) your great-grandparents are considered close relatives.

Specifically, you and your mother’s first cousin both descend from a (4) great-grandparent, and are first cousins once removed (right most column, second bubble).

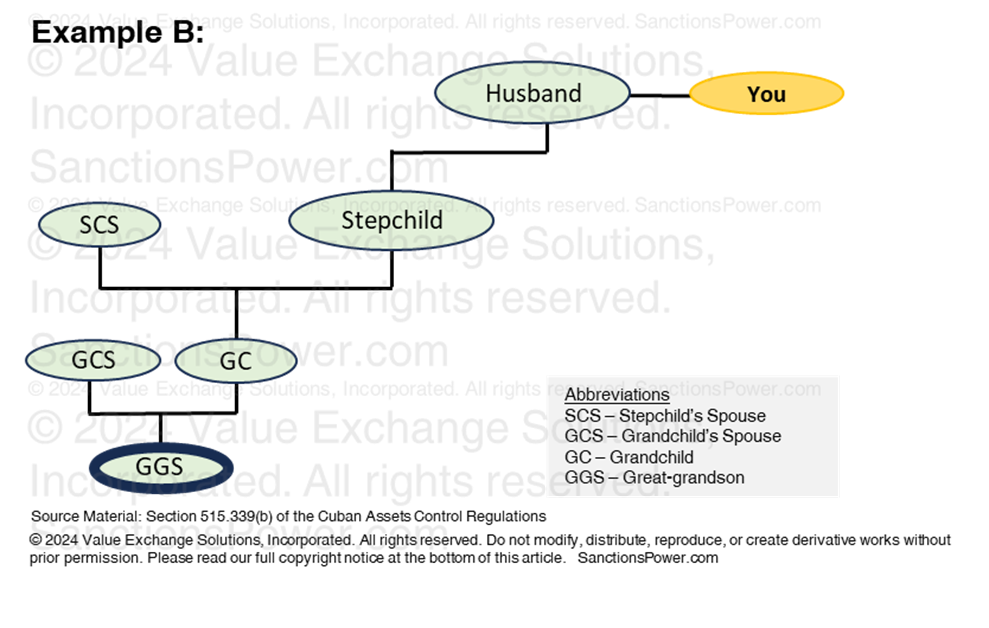

Now on to the second example provided in the regulations, quoting in full:

Similarly, your husband's great-grandson is your close relative for purposes of this part, because he is no more than three generations removed from your husband.

This is an interesting choice of words – “your husband’s great-grandson”. It seems to imply that your husband’s great-grandson might not also be your great-grandson. In other words, he could also be the descendent of your stepchild with your husband.

Furthermore, this example statement helps us understand the definition given at the beginning,

any individual related to that person by blood, marriage, or adoption who is no more than three generations removed from that person or from a common ancestor with that person.

that the crucial relation is to your husband. Your husband’s great-grandson is related to you via your marriage with your husband.

We see this relationship illustrated as follows:

In other words, stepchildren, spouses, and their descendants all count as ‘close relatives’ so long as they fit into the generations delineated in The Close Relative Family Tree, as shown below.

Logically speaking, following from your husband’s great-grandson being absorbed into your Close Relative Family Tree, it would seem to us that your spouses’ parents (parents-in-law), grandparents, great-grandparents, etc., would also be considered a close relative of yours, as long as they belong to your spouse’s Close Relative Family Tree.

However, it’s not entirely clear how far does being ‘related by marriage’ extend to….

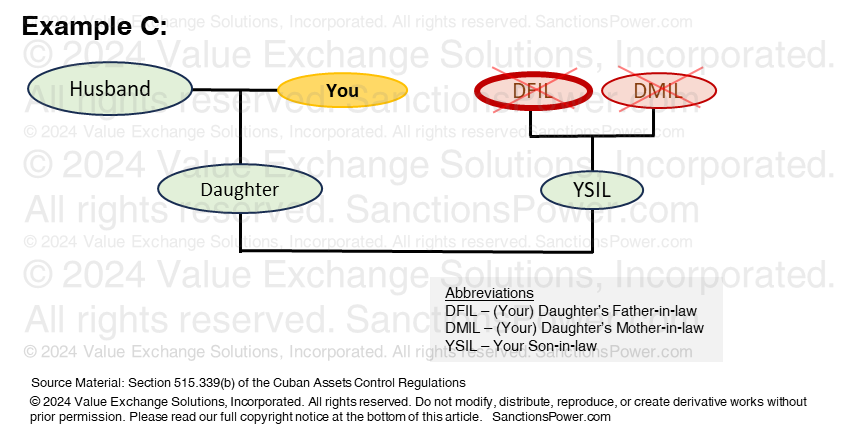

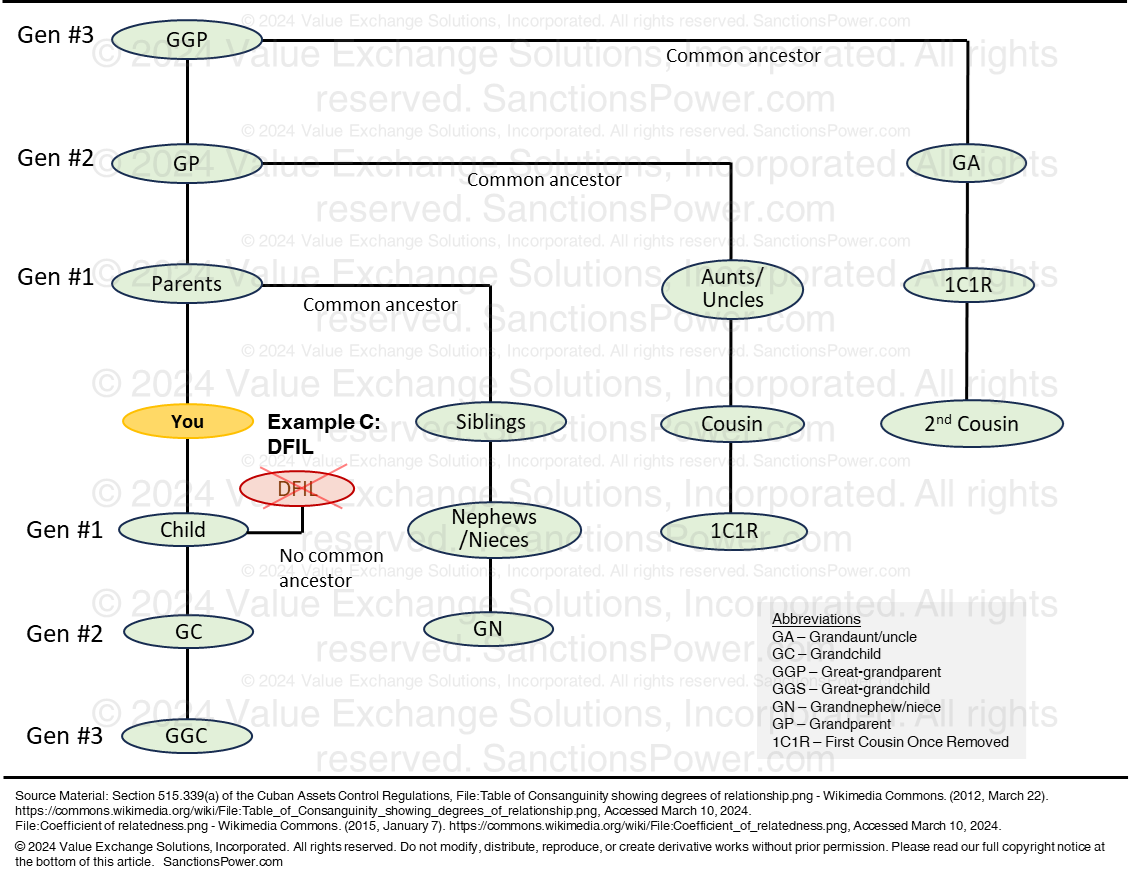

Helpfully, the last example in Section 515.339(b) provides:

Your daughter's father-in-law is not your close relative for purposes of this part, because you have no common ancestor.

In some cultures, some might think that your daughter’s father-in-law are also family, or at least as ‘in-laws’, especially if you share grandchildren. However, for the purposes of compliance with Section 515.339(b) of the Cuban Assets Control Regulations, they are not ‘close relatives’: you share no common ancestor with your daughter’s father-in-law; they simply do not fit into The Close Relative Family Tree of those who are related via a common ancestor.

Lingering questions

What hasn’t been specifically mentioned in the definition or examples?

- If you are not effectively married but have children with someone

- If you were once married to someone

For a conservative approach to complying with the prohibition on sending money to close relatives of prohibited government officials or Politburo member, we would err on the side of caution, and consider ex-spouses and extramarital partners to be part of the ‘close relative’ definition. This is also in line with what OFAC has publicly stated for the “close associates or family members” definition in section 233 of CAATSA.

To comply with family remittances, we would consider the parent of your child and his/her family to be close relatives, especially if the funds will benefit your child. We believe this is in-line with others in the industry.

We would not consider other ex-es with whom you don’t have children to be a close relative. If you would like to send them money, you may send them money under the general license of donative remittances, also covered in the same section 515.570 of the Cuban Assets Control Regulations.

We currently do not expect to face situations that would require this level of nuance in the definition thus far and continue to serve our valued guests through our mobile apps available on iOS and Android.

If you have any questions or clarifications, please write to us at legal@trylindo.com. We take your feedback and questions seriously!

In conclusion

In conclusion, we have learned who is defined as a Close Relative in Section 515.339 of the Cuban Assets Control Regulations. A helpful way of thinking of it visually, is anyone who fits into someone’s Close Relative Family Tree, by blood, marriage, or adoption, is considered a “close relative” for the purposes of Section 515.339 of the Cuban Assets Control Regulations:

Like this article? Subscribe for more. Our next article will review a chapter of the book, Sanctions as War.

Sources:

Section 515.339 of the Cuban Assets Control Regulations, located at eCFR :: 31 CFR 515.339 -- Close relative. Accessed March 10, 2024.

File:Table of Consanguinity showing degrees of relationship.png - Wikimedia Commons. (2012, March 22). https://commons.wikimedia.org/wiki/File:Table_of_Consanguinity_showing_degrees_of_relationship.png, Accessed March 10, 2024.

File:Coefficient of relatedness.png - Wikimedia Commons. (2015, January 7). https://commons.wikimedia.org/wiki/File:Coefficient_of_relatedness.png, Accessed March 10, 2024.